Money and relationships are often depicted to be like oil and water – they don’t mix. Now it’s considered taboo in both the dating world and relationships. *If you’re in a committed relationship, you can head over to my post on How to Talk About Money in Relationships. The real problem is dating couples fail to ask the right questions and to make observations regarding finances early on; it’s uncomfortable, vulnerable, private, forward and superficial. Yet having the discussion is still important, so here’s how to talk about money with someone you’re only dating.

My husband has a finance degree, and even though its not his career choice it’s his secret but not so secret calling. Savvier than I am, I wanted to completely pick his brain on this topic. Particularly, how couples who are freshly or newly dating should have The Money Talk.

What we unpack in this post:

First thing’s first, he said couples need to get more comfortable talking about finances sooner, especially when you consider that each and every person’s livelihood ultimately depends on that paper dollar. And by doing so, almost right off the bat you will be able to distinguish two things about someone:

- Whether they live to Work, or

- they work to Live.

I’d say that alone is pretty freaking important and impactful, right??? So let’s start taking the steps to remove that stigma and untouchable “POWER” behind money because at the end of the day it can either be divisive or bring you closer.

You choose.

Money and dating isn’t taboo – How to talk about money

Again, my husband is a finance guru , but he also has detective skills (no, really), so he knows his stuff when it comes to asking the right questions to get certain answers. Bear in mind that some of this may not apply to you, but we collaborated on particular questions to help you get a better understanding of one another’s money “savviness”, financial goals, and spending lifestyle.

The focus, at this point in the dating phase, is compatibility.

It’s also important to note that individual income is NOT the determining factor for financial compatibility. For instance, two very well-off individuals with extreme differences in spending habits or financial goals may not be financially compatible. And remember, inflexibility (the inability to compromise, bend or meet somewhere in the middle) is also incompatibility.

And while it’s no secret that asking someone on a first date, “How much money do you make?” and others alike are not considered normal to ask someone you hardly know, those questions don’t stir up curiosity for long-term compatibility, either. When you’re dating, or on your few first dates with someone, you want to keep it light-hearted and fun, not interrogative.

It’s understandable that there are certain questions deemed private and invasive per individual, so the key is making your own observations [in time] and to ask leading questions to get the ball rolling and hopefully unpack those questions more in-depth if/when there’s progress through connection.

Focus on potential connection, not logistics

You’re just dating, so you should solely be focusing on a potential connection. Sure, while financial compatibility does make up a portion of that connection – since you probably want to be somewhere on the same page in terms of goals, lifestyle and stability – money, or how much they make/have, shouldn’t be the determinant.

Yet most tend to focus on the logistics when getting to know someone, which can be a bit of a drab. And we’re pretty good at being cheeky about it these days, yet the logistical implications are still there. This can obviously and rightfully come off sounding *judgy*.

What am I talking about specifically? Well, it’s really anything that sounds like a superficial check list. Nobody wants to feel like they’re only good for what they provide to the table in terms of monetary value and financial success.

Questions to avoid:

“I’m assuming because of where you chose dinner (hinting that it’s a fancier restaurant) that you’re obviously comfortable paying your bills?“

“You’re not even 30 and you mentioned already how much you’ve moved up in your company, so you must be sitting pretty as far as savings goes?“

“Sooo…you’re in school right now, but you don’t even work? You’re just going to enter into the workforce with zero dollars and no work experience under your belt?“

“I live a fairly lax lifestyle as far as spending goes and I do tend to gravitate toward the finer things. By the looks of your car, I get the feeling things are a bit different for you.“

Questions to focus on:

“Fill me in on your current lifestyle and what that typically looks like? *What would be your ‘preferred’ lifestyle if money was no factor?“

“What’s your job like? *Do you enjoy it? Is this your life-long career, or is it a bridge to something else?“

“What’s your plan once you get close to finishing school?“

“Realistically, how would you describe living a *comfortable* life? What’s that look like to you?“

Be more observational, not interrogative

Touching on the above, the worst kind of date are the interrogative ones on top of logistics. You know, where it’s no longer really about getting to know the person but it’s basically a partnership interview.

How…romantic. Okay, okay, okay, technically, it is a partnership you’re agreeing to. But not at this stage, so pump the breaks!

I’m not denying it, but we can pinpoint bits and pieces of what that potential partnership might look like in a way that is less interrogative and more observational. What do I mean by this? Instead of asking questions, start paying more attention to certain details about them over time. While nobody likes wasting their time, we really have to come down off this hill that says we ought to make a point blank decision about someone on the first date.

Getting to know someone takes time, and most aren’t chomping at the bit to share certain, sensitive information (that, frankly, isn’t anyone else’s business at that point). It’s not necessarily dishonest or secretive on their part, per say, when your focus is simply to get to know them for by what they’re showing you at the moment and not for how much is in their wallet and what’s on their resume.

Observations to notice: *remember, not all observations are facts and can simply be assumptions

They mentioned numerous times how often they seem to live paycheck to paycheck without giving any inclination of a solution or strategy.

They talked about working towards the many future goals that involve having set aside or budgeted finances, like travel, buying an RV, a home, living on a plot of land, etc.

You notice they drive a luxury car and have a love for upscale taste in fashion but their current job does not reflect their spending.

[pt_view id=”6be1cf2xi0″]

Pinpoint not just red flags, but also green flags

Noticing red flags are important – we [should] know this by now. But we should put just as much emphasis on the green flags as well. Not necessarily to cancel out red flags, but that in the event there are none. We’re quick to point out the dangers but are we as keen on pointing out the good? Oftentimes I feel green flags pertaining to finances go unnoticed when they deserve time in the spotlight.

These flags will obviously look a lot different for everyone, so it’s important not to base red flags – in terms of money – on what mainstream tells you. “Don’t settle for anyone who doesn’t make at least six figures,” and the slew of nonsense alike.

My husband didn’t make anything close to six figs when I met him, yet he’s incredibly smart with his money that enabled him to own and pay off a house on his own in his mid 20s. That’s besides the point – financial compatibility isn’t about a number or scale, it’s about lifestyle, habits, patterns and life choices.

Red flags:

They insist on going to your place until their utilities are *back on*.

He’s staying on his roommate’s couch (of 3) until he finds his own place, but you find out he’s been willingly soaking up that life for years.

She’s voiced that she can’t afford an oil change on her car….yet had the money to get her hair done.

He asks you for money to help pay his bills….except that money went to new rims on his car.

Green flags:

They inform you of an unexpected financial struggle, and that they need to scale back their leisure spending for a while.

She’s excited because she received a promotional bonus from work, so you ask her what she’s going to spend it on, and she responds that the money is going in her 401K or savings.

They’re open about what they can afford on dates, how much, how often, etc..

She has firm boundaries on her vacation budget (where, how much, and how often) because she has made it clear she is working on her savings goals.

Unpack financial compatibility more in depth

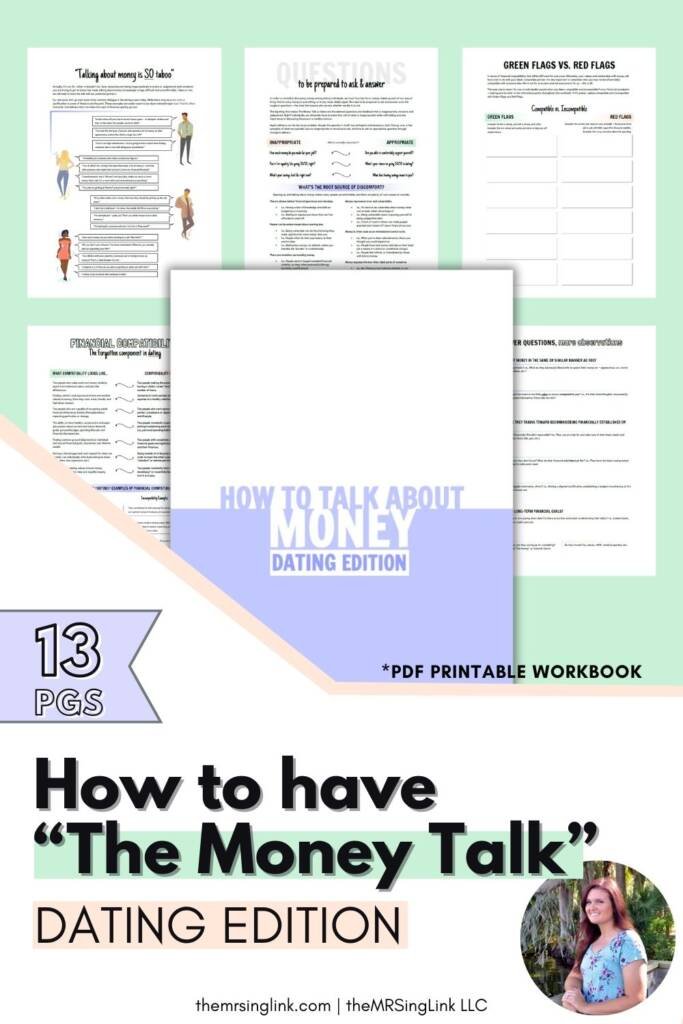

While this post is simply a brief overview, I’m a business owner and I can’t just give out all the good stuff for free. So I came up with a more in-depth workbook on how to have the money talk for helping individuals understand financial compatibility in dating.

Trust me, if money, stability and financial compatibility matters to you in a potential partner…you’re going to want this printable on hand. I’m not jerking your chain, or your wallet, here.